With the recent changes to U.S. customs duty policies, the cost and process of shipping luggage, luxury goods, or e-commerce parcels across the border are changing. Understanding these rules helps you avoid unexpected fees and delays. UUCargo summarizes the key updates and offers practical shipping tips.

1.U.S. Ends the “De Minimis” Duty-Free Threshold

Starting August 29, 2025, the United States will suspend the duty-free exemption for commercial imports valued at USD 800 or less (“de minimis” exemption). This means international express shipments to the U.S. may now incur customs duties or taxes even if their declared value is under USD 800.

2. New Charges for Postal Shipments

Parcels sent through the international postal network will also face new fees. For the next six months, U.S. Customs may charge either an ad-valorem duty based on the country of origin or a fixed item duty of USD $80/$160/$200 depending on that origin country’s tariff rate.

3. Different Duty Rates by Product Category

U.S. Customs uses HS/HTS codes (Harmonized Tariff Schedule) to determine duty rates. Everyday consumer goods typically fall in the 2.5%–6% range, while certain categories may be as high as 30%–40%.

4. Additional Cross-Border Shipping Fees

Beyond duties themselves, carriers or customs brokers may charge:

- Brokerage fees

- Disbursement fees for advancing duties/taxes

- Extra documentation fees (e.g., Manufacturer Identification Code, MID)

FedEx’s update on the new rules: FedEx – U.S. Tariff Impact

5. Who Pays Duties and Taxes?

Whether the shipper or recipient pays duties/taxes depends on how the shipment is set up (shipper pay / recipient pay / third-party pay). If not clearly specified, the recipient is usually billed.

6. How to Estimate Costs in Advance

Use online tools from carriers or UUCargo to estimate landed costs (shipping + duties + clearance fees):

- FedEx Global Trade Manager

- UPS Import Control

- DHL Duty & Tax Calculator

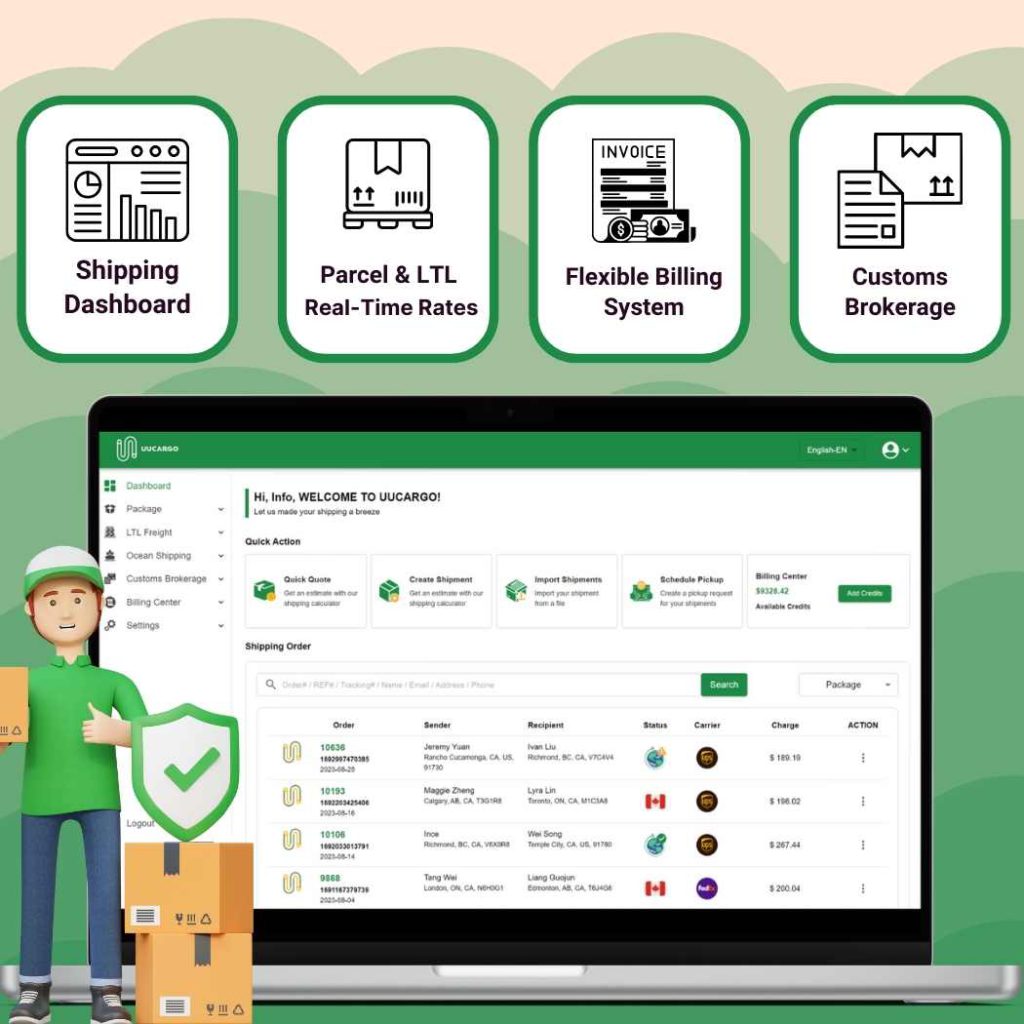

On the UUCargo website, simply enter the package weight and dimensions to compare real-time rates from major couriers, enjoy up to 80% off, and access one-stop customs, insurance, and packaging guidance:🔗 UUCargo – International Shipping Rate Check

7. Accurate Declarations and Documents

To avoid delays or penalties:

- Provide a complete commercial invoice

- Include correct HS code and country of origin

Declare the true value - Keep photos and a packing list for reference

8. UUCargo Packing Tips

-

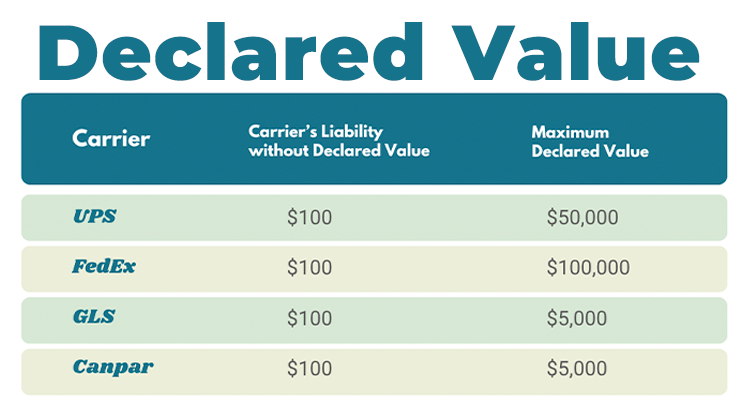

Insure valuable items: For luxury goods, watches, and jewelry, choose signature-required and insured services.

-

Professional packaging: Use sturdy boxes, bubble wrap, waterproof bags, and vacuum bags. Original packaging plus cushioning offers the best protection.

-

Easy supply shopping: Canada Post stores, Walmart, Canadian Tire, Home Depot, and Dollarama all sell common packing materials.

Conclusion

With U.S. tariff policies changing, cross-border shipments are no longer automatically “duty-free” for low-value items. Preparing in advance, declaring accurately, and choosing reliable carriers or agents are key to smoother, lower-cost shipping.

UUCargo continuously monitors policy changes to deliver up-to-date cross-border logistics information and discounted rates—helping you ship globally with more confidence and savings.